Check your eligibility by connecting your MetaMask to the official website or Dune dashboard. The team allocated 15% of the total supply to early adopters, with amounts scaling based on interaction tiers–ranging from 50 tokens for basic swaps to 5,000+ for heavy DeFi users.

The price remains speculative until exchange listings, but crypto trackers estimate $0.12–$0.30 per token based on staking derivatives activity. For context, similar Layer 1 launches in 2023 had 3–8x returns post-claim.

How to get involved:Phase 1 (live): 40M tokens for testnet contributors (GitHub commits count)

Phase 2 (starts Q3): 110M tokens for liquidity providers

Phase 3 (TBA): 50M tokens reserved for blockchain developers

Refer to the project’s blog for exact dates–snapshot was taken May 18, but latecomers can still qualify in season 2. Avoid scams: only use the link from their verified web portal.

Pro strategy: Combine testnet activity with mainnet staking to maximize allocations. The top 2,000 addresses by combined score received 12% larger drops in the last review cycle.

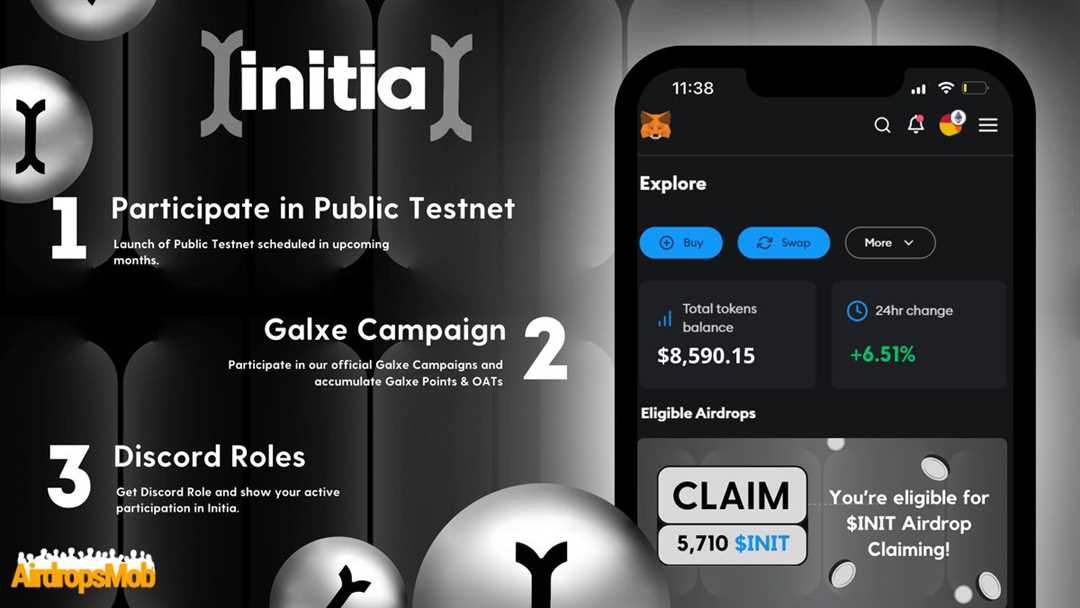

What is the Initia airdrop and how does it work?

Check eligibility via the official website or a third-party checker before claiming. Unclaimed tokens expire after the distribution date.

- When is it happening? The schedule shows waiting periods between season rounds.

- How many tokens? Size varies per wallet based on staking activity or validator status.

- Is legit? Verify contract addresses on Etherscan before interacting.

Connect your Metamask or compatible wallet to the project’s web portal. Missed allocations may appear as unclaimed due to snapshot timing.

- Review requirements: Minimum DeFi interactions or holding specific coin balances.

- Follow the guide on the site–avoid unofficial Telegram links.

- Claim free tokens before the deadline. Gas fees apply.

Worth monitoring: Early participants often receive larger cryptocurrency shares. New rounds may have stricter conditions.

For support, cross-reference announcements with the team’s verified page. Scammers frequently mimic crypto giveaways.

Eligibility criteria for the Initia airdrop

To qualify, your wallet must hold at least 0.05 ETH during the snapshot taken on March 15, 2024. Exchanges and smart contract addresses are excluded.

Mandatory actions

Complete these steps before the date closes:

- Follow the official Twitter & Telegram

- Retweet the pinned post with #InitiaRewards

- Interact with the testnet (minimum 3 transactions)

| Factor | Requirement | Verification |

|---|---|---|

| Wallet activity | 5+ DeFi swaps since Jan 2024 | Blockchain checker |

| Social proof | 150+ followers minimum | Web validator tool |

| Token allocation | 50-500 coins per user | Depends on wallet size |

Common disqualifiers

These will void your qualification instantly:

- Using VPN during claim process

- Duplicate GitHub accounts

- No KYC where required

Check your status on the project’s website using their online portal. The price per token won’t be disclosed until TGE. If you missed the window, no secondary distributions are planned.

Step-by-step guide to registering for the Initia airdrop

1. Verify eligibility using the official Dune dashboard or a third-party checker. Minimum wallet activity and tier thresholds apply.

- Check Medium or the project’s Telegram for qualification conditions.

- Snapshot date typically precedes the announcement by 7-14 days.

2. Connect your wallet (MetaMask recommended) to the designated web page before the deadline. Gas fees under $0.50 optimize cost.

- Confirm network compatibility (EVM chains preferred).

- Whitelist the distribution contract address to avoid spam filters.

3. Complete tasks for higher allocation tiers:

- Stake ≥ $200 in DeFi farming pools linked on the project’s website.

- Run a node (minimum device specs: 4GB RAM, 50GB storage).

- Share referral codes via Twitter/Telegram for +5% bonus.

4. Track progress:

| Metric | Tool | Frequency |

|---|---|---|

| Token value estimate | CoinGecko API | Real-time |

| Claim status | Block explorer | Post-deadline |

5. Claim tokens within 72 hours of distribution. Delays risk forfeiture.

- Average allocations: 500-5,000 tokens per address.

- Tax implications: IRS Form 8949 required for disposals over $600.

For disputes, submit tx hashes via GitHub issues. No support for hardware wallet errors.

How to connect your wallet to the Initia platform

Open your preferred wallet (MetaMask, Trust Wallet, etc.) and switch to a supported network–Ethereum, Solana, or BSC. The contract address for bridging is available in the official Telegram announcements.

Step-by-step setup

1. Navigate to the platform’s wallet connector page. Look for the “Connect Wallet” button–usually top-right.

2. Approve the connection request. Some wallets require manual chain ID entry; verify this matches the testnet or mainnet node.

3. If the interface shows “waiting,” refresh or check gas fees. High congestion delays transactions.

Troubleshooting & value checks

– Missed the deadline? Unclaimed tokens may still appear if you meet eligibility conditions. Use the wallet checker tool to verify qualification status.

– Farming or validator strategies require holding a minimum token value. Cross-reference the schedule with current price trends.

– Suspect an error? The support team confirms legitimacy–scams often mimic the official contract.

New users: Always confirm the free list of approved wallets before linking. Fake sites steal credentials. For latest updates, track the news section or node announcements.

Verification process for airdrop participants

Connect your wallet (MetaMask, Trust Wallet, etc.) to the official claim page before the snapshot deadline. Missing this step voids eligibility.

- How to verify: Submit your ERC-20/BEP-20 address via the project’s site or Telegram bot. Cross-check the URL to confirm it is legit.

- Conditions: Most drops require holding a minimum amount of a specific token or staking in a validator pool. Check the rules on their Medium or web docs.

- Allocation tiers: Rewards scale based on activity (e.g., 500–10,000 tokens for early staking, 1,000–50,000 for liquidity providers).

When is distribution? Typically 7–14 days post-snapshot. Track the schedule via the project’s blockchain explorer or Twitter.

- Go to the claim page after the drop goes live.

- Approve the contract interaction (gas fees apply).

- Check your wallet balance–tokens auto-deposit unless manual collection is required.

How many tokens you get depends on:

- Your tier (e.g., Tier 1: 1,000 tokens, Tier 2: 5,000 tokens).

- The price of the token at snapshot.

- Whether you completed KYC (some projects mandate it).

Support issues? Avoid scams–never share private keys. Legit teams won’t DM you first on Telegram.

Review the distribution mechanics: Some projects lock tokens for 3–12 months. Calculate if the drop is worth your time.

Key dates and deadlines for the Initia airdrop

Mark your calendar: The claim page opens on June 15, 2024. Unclaimed tokens expire after 30 days.

Season 1 distribution:

- Snapshot date: May 1, 2024 (block 18,450,000)

- Eligibility checker live: May 10

- Staking rewards calculated: May 20

Tiers & allocation:

| Tier | Amount | Requirements |

|---|---|---|

| Early | 500-1,200 tokens | Interacted with contract pre-March |

| Active | 200-800 tokens | 5+ TXs or $500+ staked |

Track value: Use the Dune dashboard or coin tracker to monitor real-time worth. Current estimates: $0.18-$0.35 per token.

Critical deadlines:

- GitHub commits cut-off: April 25 (for dev allocations)

- Telegram group verification: Must join before May 5

- Farming period ends: June 1 (23:59 UTC)

Post-distribution: Tokens unlock linearly over 90 days. Check the web for contract audits proving it is legit.

How to check your airdrop allocation status

Visit the official claim page linked on the project’s website or GitHub. Enter your wallet address to see if you’re eligible. The tracker will display how many tokens you qualify for or if it shows waiting for further action.

Steps to verify eligibility

1. Check the contract address on a block explorer like Etherscan. Confirmed distributions will reflect there.

2. Cross-reference the list of qualified wallets–some DeFi projects publish these on their site or testnet documentation.

3. If your allocation is unclaimed, follow the deadline–most projects enforce a 30-90 day window.

Common issues & fixes

– If the tracker shows waiting but you met conditions, contact support with proof of on-chain activity.

– Verify the token is legit by confirming the smart contract matches the announcement.

– For node operators: some seasonal rewards require manual claiming via CLI tools.

When is distribution? Check the project’s date tracker–typically 1-4 weeks after the qualification snapshot.

Common issues and troubleshooting during participation

Can’t claim tokens? Verify eligibility using the tracker tool. If your wallet isn’t listed, check the snapshot date–some users missed the cutoff.

Allocation smaller than expected? Cross-reference your activity (e.g., staking, farming) with the project’s blog or Medium. Typos in Metamask addresses are a frequent culprit.

Deadline passed? Most distributions lock after the schedule ends, but monitor Twitter for announcement extensions. Scammers exploit FOMO–always confirm is legit via GitHub or official channels.

Device waiting on transactions? Adjust gas fees during low-traffic periods. For free claims, avoid peak hours when networks clog.

Node sync failures? Update client software. Projects often post fixes in support forums before pushing news updates.

Price discrepancies post-drop? Check if tokens are online in liquidity pools. Early trades on thin markets skew valuations.

How to verify your share? Compare your amount against the project’s distribution formula–some reduce rewards for inactive wallets.

Strategy adjustments: If you missed season 1, review how to qualify for future rounds. Active engagement (e.g., farming, bug reports) often boosts allocation.

Tax implications and reporting for airdrop recipients

Report airdropped tokens as income at fair market value on the date received–failure to do so risks IRS penalties. Track price using Dune Analytics or CoinGecko at distribution time.

| Scenario | Tax Treatment | Documentation Required |

|---|---|---|

| Tokens received without staking | Ordinary income (Form 1040) | Blockchain tx hash, wallet address |

| Testnet rewards converted to mainnet | Taxable upon mainnet claim | Github proof, allocation schedule |

| Staking/farming rewards | Additional income upon receipt | Validator node logs, tier breakdown |

Use eligibility checker tools before claiming–projects often impose lockup periods or vesting conditions that alter tax timing. Cross-reference Telegram announcements with the project’s official blog for accurate distribution dates.

For tokens showing “waiting” status on tracker sites: Record zero value until transfer completes. The taxable event occurs when coins hit your wallet, not when qualification is confirmed.

Three critical IRS compliance steps:

- Calculate USD value using token price at receipt time (not claim date)

- Maintain screenshots of allocation amounts from the project’s web interface

- File Form 8949 if selling within 12 months (short-term capital gains)

Warning: Farming strategies that auto-compound rewards create continuous taxable events. Nodes generating daily payouts require meticulous daily price tracking–consider crypto-specific tax software.

Projects deemed illegitimate by the SEC (check CoinDesk news archives) may still require reported income. The IRS cares about receipt, not project validity.

FAQ:

What is the Initia airdrop and how does it work?

The Initia airdrop is a distribution of free tokens to eligible users as part of the project’s community rewards program. To participate, you typically need to complete specific tasks like joining their social channels, holding certain assets, or interacting with their platform. The exact steps are outlined in their official guide.

Who can qualify for the Initia airdrop?

Eligibility depends on the project’s requirements, which may include early supporters, active community members, or users who meet certain criteria like wallet activity or referrals. Check Initia’s official announcements for the latest details on who can claim tokens.

When will the Initia airdrop tokens be distributed?

The distribution date varies by project. Initia usually announces timelines in their official blog or social media. Some airdrops happen immediately after verification, while others may follow a vesting schedule.

Do I need to pay gas fees to receive the airdrop?

No, legitimate airdrops don’t require payments. If a platform asks for funds upfront, it’s likely a scam. However, you might need a small amount of native tokens in your wallet to cover transaction fees when claiming or transferring airdropped tokens.

How can I avoid scams during the Initia airdrop?

Only use official links from Initia’s verified website or social media. Never share private keys or sign suspicious transactions. Double-check contract addresses and avoid clicking on unsolicited messages promising free tokens.